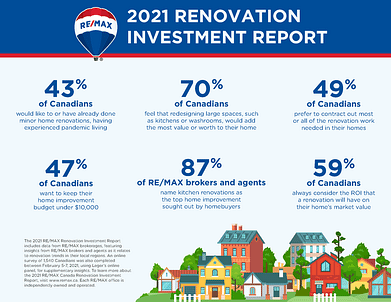

LUMBER PRICES ARE FALLING, BUT HOUSING AFFORDABILITY REMAINS AN ISSUE.

With interest rates reaching historic lows in a persistent seller’s market, the new-home construction industry is facing a test of successfully balancing supply and demand. In the premiere episode of the interactive series “Keepin’ It Real with Nick Bailey,” RE/MAX President Nick Bailey and two guests explore all sides of the new-home construction market.…

Details